All adult Singaporeans will each receive a cash payment of between S700 and S1600 over five years starting this year Finance Minister Lawrence Wong announced today 18 February during his budget speech 2022. The GST Voucher Cash Special Payment will be disbursed in June 2021.

Budget 2022 S Poreans Aged 21 And Above To Get S 700 To S 1 600 Cash Payout Over Next 5 Years News Wwc

Sporeans aged 21 and above to get S700 to S1600 cash payout over next 5 years Zafirah Salim February 18 2022 Finance Minister Lawrence Wong announced today February 18 that GST will go up from 7 per cent to 8 per cent on 1 January 2023 and 9 per cent on 1 January 2024.

. Article explains changes vide Union Budget 2022 related to Changes in Input Tax Credit Additional Condition of taking Input Tax Credit Auto generated statement Input tax Extension of Due date for availing ITC Availment of input tax credit Restriction on credit usage Cancellation of GST Registration. 23 hours agoBudget 2022. 18 during his Budget.

The current payout is either 150 or 300 and is distributed to Singaporeans with annual income of 28000 and below. S700 to S1600 cash payout. Feb 19 2022 Two programmes have been put in place to cushion the blow for ordinary Singaporeans.

1 day agoAll adult Singaporeans will each get a cash payout of between S700 to S1600 over five years starting from this year Finance Minister Lawrence Wong announced today Feb. They would have received a special payment amounting to an additional 50 per. Two tranches of S200 Community Development Council CDC Vouchers.

When Will I Get My GST Voucher Cash. And the GST Voucher Cash will be disbursed in August 2021. GST Budget 2022 Updates.

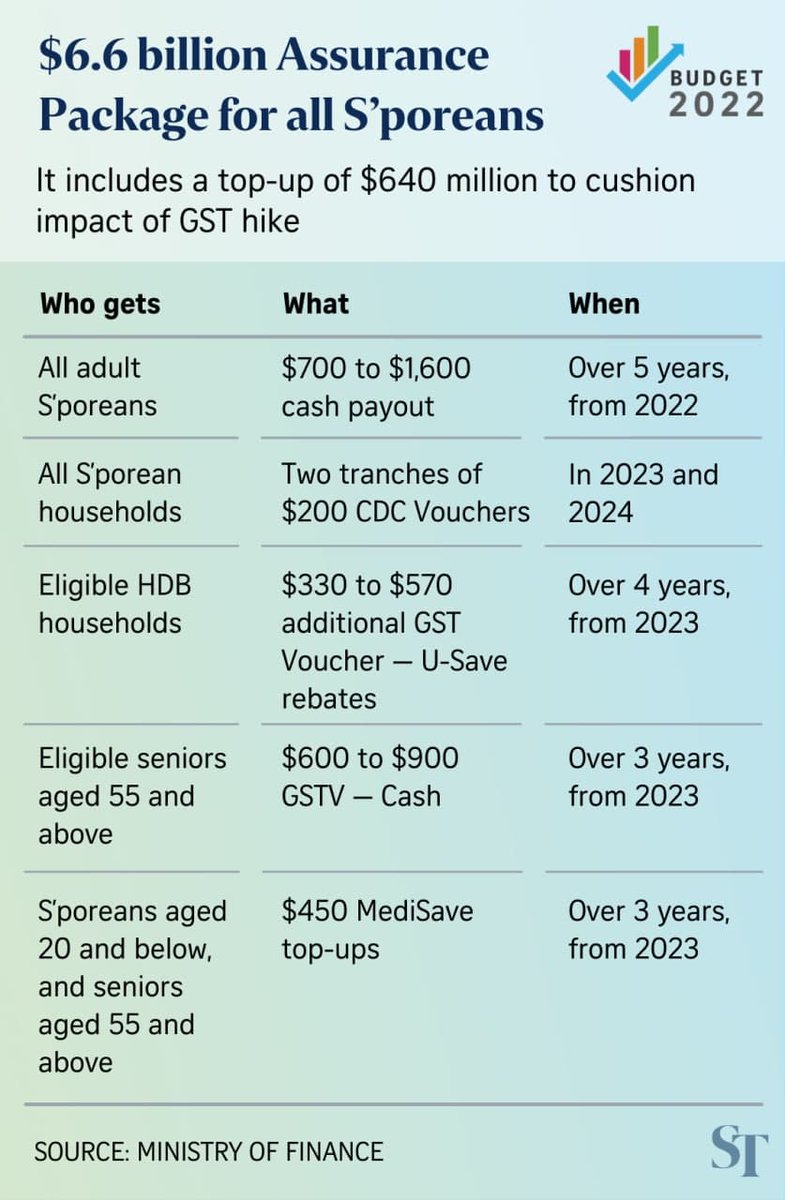

Assurance Package increased to 66 billion GST voucher scheme beefed up to offset GST hike The GST rate will increase from 7 to 9 per cent in two stages - one percentage point each. 19 hours agoPayout period. January 5 2022 April 5 2022 July 5 2022 October 5 2022 You can receive your payments via direct deposit to your Canadian bank account.

GST Voucher 2022 payout date GST is a regressive tax which means it disproportionately affects the poor who spend a higher fraction of. Govt Proposes for the extension of deadline for claiming ITC. Singaporeans who own zero or one property with an annual income of less than 34000 will receive 1600 over the next five years.

All adult singaporeans will each get a cash payout of between s700 to s1600 over five years starting from this year finance minister lawrence wong announced today feb. The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these due dates. Assurance Package to offset GST hike increased to S66 billion with cash payouts for all Sporean adults SINGAPORE All Singaporeans aged 21 and above will receive cash payouts of.

Top Changes made under GST Amendments in Budget 2022. GST Registered taxpayers would be eligible to transfer their surplus E-Cash Ledger. Every Singaporean aged 21 years and above will receive cash payouts amounting to between 700 to 1600 depending on hisher income and property ownership see Table 1.

You are encouraged to link your NRIC to PayNow to receive your GST Voucher Cash earlier. It was actually implemented in order to enable Singapore to lower its corporate and income tax rates effectively shifting the burden of generating tax revenue to the poor. Follow us on Telegram for the latest updates.

Supply of goods by any unincorporated association or body of persons to a member thereof for cash deferred payment or other valuable consideration. Singapore is delaying its planned GST increase amid the ongoing COVID-19 pandemic rising inflation and a recovering economy. Five years from 2022.

The Straits Times SINGAPORE - Between 2023 and 2024 Singapores goods and services tax. 23 hours agoBudget 2022. The first payout will be made in December 2022.

GST cash voucher payouts under the scheme will go up to either 250 or 500 with the exact amount depending on the value of ones home. The payouts will be disbursed over five years from 2022 to 2026. If you want to make sure that you get your money ASAP youll need to set up your PayNow and get it linked to your NRIC.

1 day agoGST Voucher 2022 payout date. S330 to S570 additional GST Voucher GSTV U-Save rebates. If youd like to view your benefit information and amounts you can do so using the CRA My Account Service.

This will benefit about 28 million adult Singaporeans. How can I update my mode of payment for GST Voucher Cash. The increase will also be imple.

Disbursed in 2023 and 2024. GST is a regressive tax which means it disproportionately affects the poor who spend a higher fraction of their income on goods and services. Extension of period for issuance of credit note along with the rectification of outward supplies already reported by a taxable person.

Those with annual income of between 34000 and 100000 will receive 1050. Register for PayNow-NRIC with your bank by 15 June 2021 to receive your cash payouts earlier from 23 June 2021. 18 during his budget 2022 speechthis is part of a s66 billion assurance package that aims to offset the increase in expenses from the gst hike also announced in the same.

GST Notifications which come into effect from 1 st January2022. All adult Singaporeans will receive cash payouts of between 700 to 1600 over five years from 2022 to 2026. Four years from 2023.

About 950000 Singapore HDB households will receive their quarterly GST Voucher GSTV U-Save rebates in January 2022.

Cna Just In Here S What You Could Get Under The Household Support Package Sgbudget2021 Additional Gst Voucher Cash Special Payment Of S 200 Additional Utilities Rebates Of Between S 120 And